In July 2021, the Department of Higher Education of the Ministry of Education issued a notice on the pilot construction of virtual teaching and research offices, which has attracted wide attention from colleges and universities across the country. According to the notice, colleges and universities should be guided by “Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era”, explore the construction standard, construction path and operation mode of new grassroots teaching organizations in the era of intelligence +. In response to this call, the School of Finance of Nankai University, together with 59 universities across the country, has set up a Robo-advisor Virtual Teaching and Research Room. It aims to improve the overall teaching level of the courses (groups) involved in the experimental teaching of intelligent investment service, help the development needs of the construction of new majors such as financial technology, investment science and financial engineering, and improve the overall professional quality of graduates majoring in finance. The first trial of robo-advisor virtual teaching and research room is bound to promote industry, university and research to learn from each other, cooperate and help each other, and explore a new way that theory and practice are closely combined and college talents serve the development of China's intelligent finance industry. At the same time, the robo-advisor virtual teaching and research room has also been supported by many domestic enterprises and institutions, including Shenzhen Wukong Investment Management Co., LTD., Shanghai Stock Exchange Product Innovation Center, Flush, Wuhan University Press, Renqiao (Beijing) Asset Management Co., LTD. In June 2022, in order to commemorate the 7th anniversary of the School of Finance of Nankai University and the 40th anniversary of the restoration of financial education of Nankai University, the robo-advisor virtual teaching and research room held three online courses exchange activities on June 12, June 15 and June 26.

On June 12th, the robo-advisor virtual teaching and research room launched the first activity, with the theme of Machine Learning and quantitative trading. The event was hosted by Zhang Huayue, Associate Professor of School of Finance, Nankai University, and Professor Liu Lanbiao, Deputy Dean of School of Finance, Nankai University, delivered the opening speech. Liu Lanbiao first expressed his gratitude to the teachers and students who participated in the activity of Machine Learning and Quantitative Trading, and then introduced the situation of the robo-advisor virtual teaching and research room and the three-course exchange activities. Professor Li Bin of Wuhan University, Professor Shi Yufeng of Shandong University and Professor Lin Hui of Nanjing University respectively reported on Asset Return Prediction Driven by Machine Learning, Intelligent Generation and High-frequency Data Analysis of Program Trading Strategy, and Program Trading of Convertible Bonds. The report mainly analyzes the development and application of machine learning and quantitative trading, the role of machine learning in intelligent investment advisory, and the generation of programmatic trading strategies for convertible bonds.

On June 15th, the robo-advisor virtual teaching and research room launched the second phase of the activity, with the theme of Investment Science and Intelligent Investment Advisory. The activity was presided over by Professor Qin Jiaqi from the School of Finance of Nankai University. The activity revolves around investment vehicles, including convertible bonds, futures and options, as well as a portfolio of assets in different trading vehicles. Among them, Professor Zheng Zhenlong of Xiamen University taught Market Efficiency and Investment Strategy of Convertible Bond Market, Professor Zhang Zongxin of Fudan University taught Derivatives Trading and Hedging Trading Strategy, and Dr. Liu Ping of Shanghai Lixin Accounting and Finance College taught Quantitative Allocation of Asset Portfolio. Zheng Zhenlong compared the advantages and disadvantages of various pricing models of convertible bonds in detail and designed investment strategies accordingly. Zhang Zongxin discussed and analyzed the cases of quantitative hedging, algorithmic trading and the development trend of derivatives market. Liu Ping compared the back test performance of different quantitative configuration methods.

On June 26th, the robo-advisor virtual teaching and research room launched the third activity, with the theme of The Practice of intelligent Investment Consultancy in China. The course exchange activity was hosted by Zhao Bo, Assistant professor of the School of Finance of Nankai University. Before the event, Wei Xu, executive deputy secretary general of the robo-advisor virtual teaching and research room of the 2022-2023 academic year and Associate professor of Central University of Finance and Economics, introduced the activity plan of the virtual Teaching and Research Office of intelligent investment in the next academic year hosted by Central University of Finance and Economics. Wei Xu expressed his respect and gratitude to School of Finance of Nankai University in the virtual teaching and Research office in the first year of the presiding work. During the activity, Associate Professor Liu Yangshu from Xiamen University gave a lecture on Quantitative Investment: Boundaries and Expansion. Associate Professor Deng Yiwei from Zhejiang Gongshang University gave a lecture on Information Extraction and Industrial Application in China's Derivatives Market. Shuai Min, director of Jianyong Asset Research in Shanghai, gave a lecture on Investor Constraint, Institutional Change and Strategy Selection. The activity discussed the localization practice of intelligent investment advisory from the perspectives of the boundary of quantitative investment, the development of China's derivative market, and the iterative evolution of China's quantitative investment strategy.

The three activities held by the robo-advisor virtual teaching and research room have received wide attention and warm welcome, with a cumulative audience of more than 700 people. The guest speakers gave detailed answers and discussions on various hot issues raised by teachers and students, including the trading strategies of convertible bonds, the development direction of quantitative investment, the application of machine learning, the information extraction of derivatives market, and the program trading of asset portfolio. The Robo-advisor is an essential tool for investment transactions in the era of big data. The activities of the Virtual Teaching and Research Room play a positive role in the popularization and communication of intelligent investment advisory related courses among colleges and universities across the country, as well as the integration of industry, education and research.

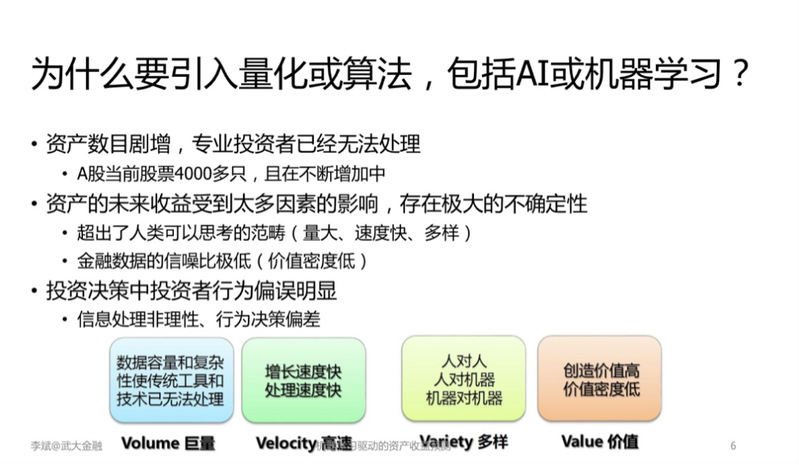

Li Bin explains the necessity of quantitative trading algorithm in intelligent investment

Lin Hui explains the program trading of convertible bonds

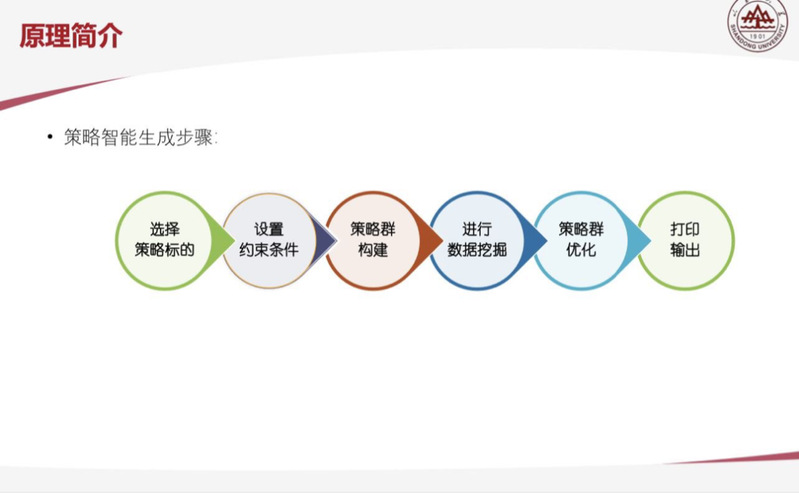

Shi Yufeng explains the steps of intelligent strategy generation

Zheng Zhenlong answers questions raised by the participants

Contact Us