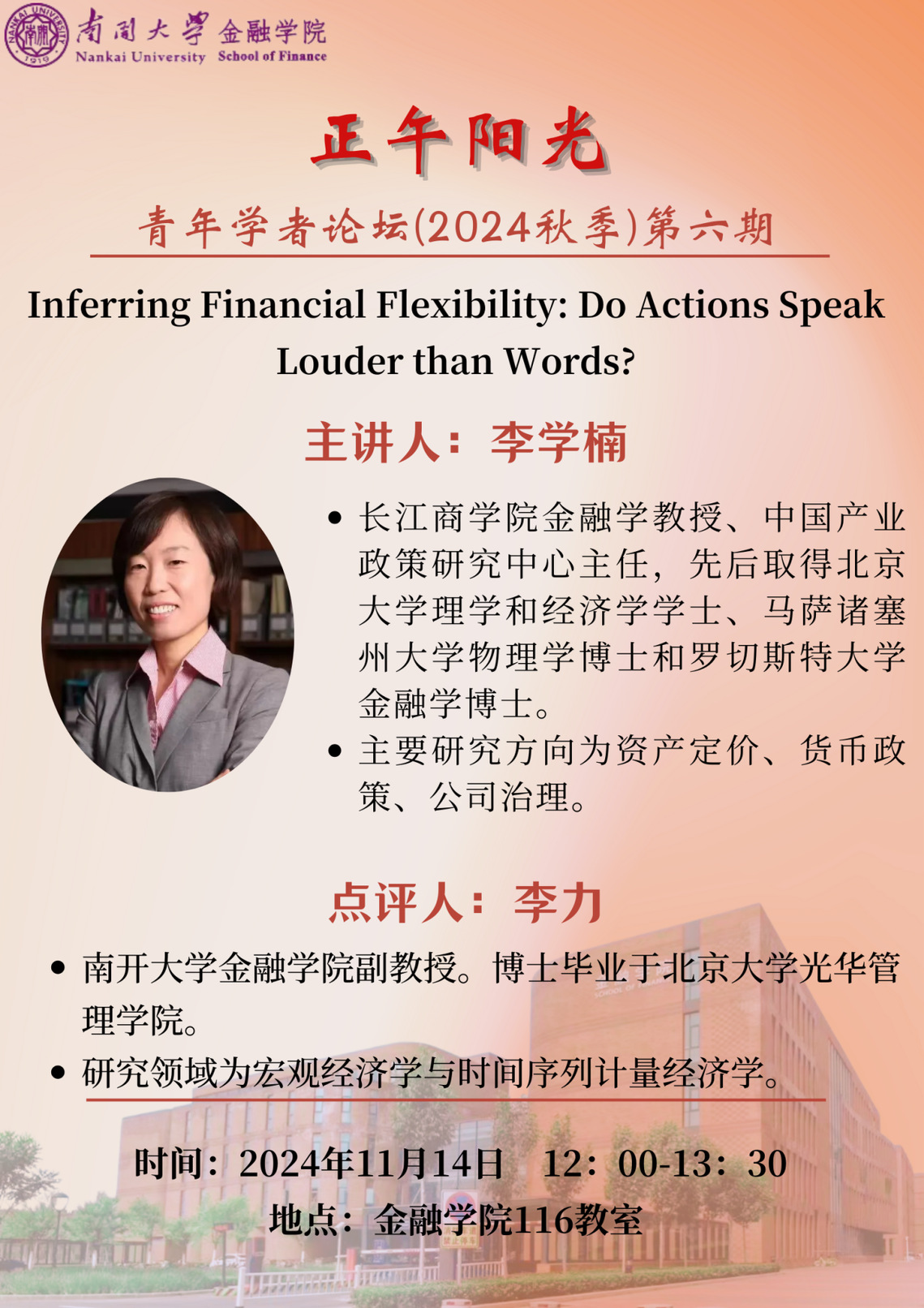

Advance Notice: the Sixth Session of Noon Sunshine-Young Scholars Seminar (the Autumn in 2024)

“Noon Sunshine-Young Scholars Seminar” is a regular academic exchange platform held by School of Finance. It aims to offer valuable occasions of communications among scholars in our college, between teachers and students, the domestic and the oversea. In this semester, we keep our original intention, set off for a new voyage. We will devote ourselves to fostering the academic atmosphere in the college, and promoting the academic level for both teachers and students.

The sixth session of “Noon Sunshine-Young Scholars Seminar” for the Autumn Semester in 2024 is arranged as follows:

Lecture topic

Inferring Financial Flexibility: Do Actions Speak Louder than Words?

Keynote Speaker: Li Xuenan

Date

Thursday, November 14th, 2024

Time

12:00-13:30

Lecture Venue

Room 116, School of Finance

Abstract

Firms invest intermittently, and a significant part of capital formation occurs during “investment spikes”. Industry-level “spike waves”, during which growth opportunities in an entire industry surge and a large fraction of firms in the industry generate investment spikes, also occur quite regularly. We define financial flexibility as the capacity to accommodate large shortfalls between a firm's investment needs and cash flow, as is the case when it has an investment spike. We develop an index for financial flexibility (FF) based on which firm-specific variables differentiate firms that generate investment spikes and those that do not during industry spike waves. In out-of-sample tests, our FF Index predicts investment spikes, as well as investment growth, future sales growth, investment in downturns and recovery, and stock returns in crisis periods. We posit that firms’ actions can be more revealing than what can be inferred from their 10-Ks about their financial status. To this end, we ask ChatGPT to “read” the “Liquidity and Capital Resources” section of a large sample of firms’ 10-Ks and classify firms on their capacity to undertake large investment. Based on these classifications, we generate an alternative “word-based” FF Index. However, our “firm-action-based” Index also outperforms this index. The predictive ability of the FF Index remains even when we control for commonly used financial constraint indices. We validate our empirical approach using data simulated in a model adapted from Gao, Whited, and Zhang (2021).