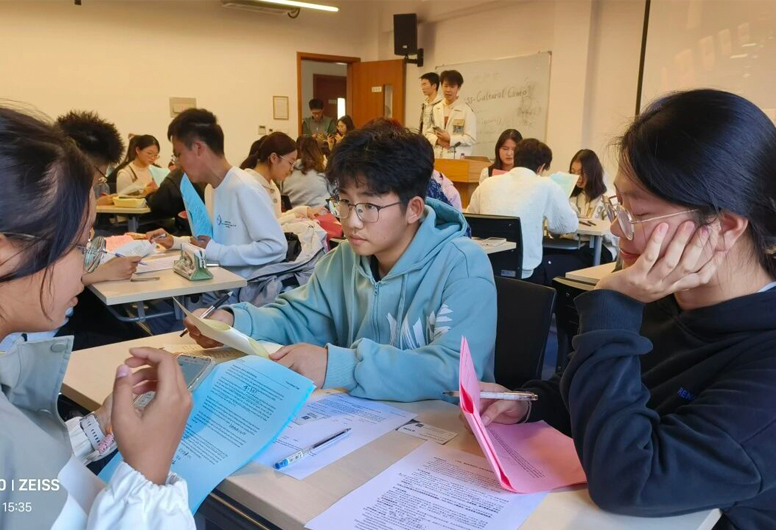

The eleventh session of Noon Sunshine – Young Scholars Seminar (the Autumn in 2021) has been held successfully.

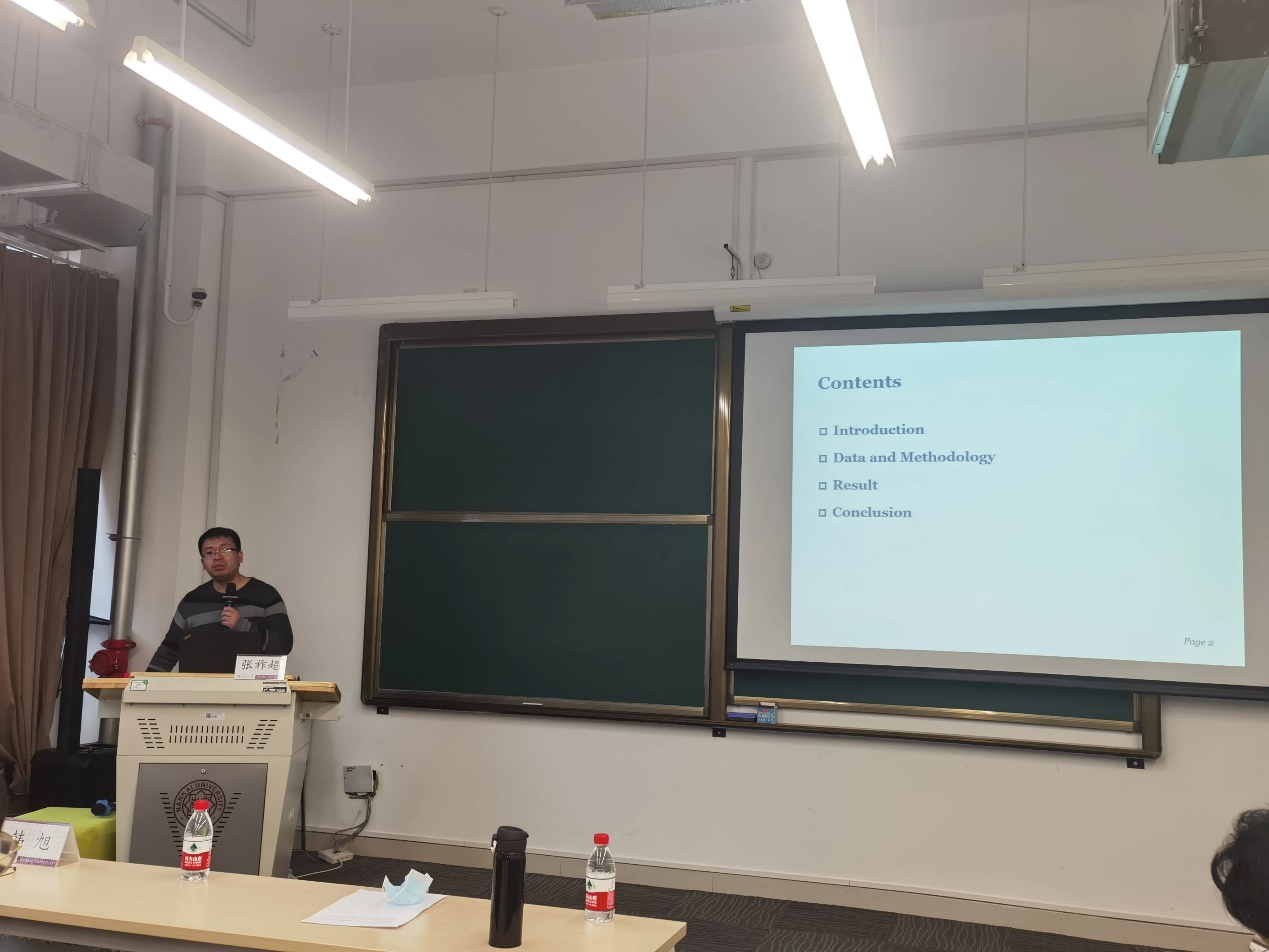

At noon on December 23, the eleventh phase of “Noon Sunshine-Young Scholars Forum” was held in Room 116 of the School of Finance. The theme of this forum is “Can media reprinting promote the transmission of company-level information?”, lectured by Zhang Zuochao, postdoctoral researcher and assistant researcher at the School of Finance of Nankai University, and Doctor of Management at Tianjin University. Zhang Zuochao’s research interests include financial big data analysis, behavioral finance, and his academic achievements have been published in journals such as China Management Science. Party Secretary Han Xu, Executive Vice President Fan Xiaoyun, and Vice President Liu Lanbiao attended the event.

Zhang Zuochao first introduced the relevant background. In the past few decades, great changes have taken place in information from production to dissemination. In particular, the emergence of media and the Internet has reduced the cost of information acquisition, the amount of information has exploded. The substantial increase in the amount of information has made information processing more complicated and the cost increased accordingly. This leads to the theme of this forum: Can a large amount of news generated by the media under the Internet background, especially a large amount of media reprint, promote the transmission of company-level information? Then Zhang Zuochao introduced his data sources and research methods. He obtained news data from the Wisers database, obtained transaction data from the CSMAR and Wind databases. He used the NLP method to distinguish the news into original news and news reprints, and used the LDA model to calculate the difference between the reprinted news and the original news content, and finally, the heterogeneous volatility is used as an explanatory variable to construct a dynamic panel for regression analysis.Finally, Zhang Zuochao showed his empirical results and conclusions. First, the reprint ratio of the media is significantly negatively correlated with the characteristic volatility of stock prices, that is, a high proportion of reprints is not conducive to the transmission of company-level information. Second, the difference between media reprints and original news has an inverted U-shaped relationship with the characteristic volatility of stock prices, indicating that the media’s differentiated reprints can convey compony-level information, but when this difference causes a special information environment to be particularly complicated, due to the limited attention of investors, it is more difficult for investors to obtain information, which is not conducive to the integration of the company’s characteristic information into the stock price. Third, because the difference between new media reprinting and original creation is smaller, the reprinting ratio of new media shows a more significant negative correlation with traditional media and the characteristic volatility of stock prices. This result is consistent with investors’ view that reprinted outdated information will produce overreaction.

“Noon Sunshine” is a regular academic exchange platform held by the School of Finance since the establishment of the Institute, which aims to help teachers focus on academic frontier issues, enhance academic exchanges and promote scientific research cooperation.

Copywriter: Zhang Kai

Photography: Wang Xiaomeng

Editor: Ma Haisong, New Media Center, School of Finance

Review proofreading: Jane Ma and Hao Ren