The sixth session of Noon Sunshine – Young Scholars Seminar (the Autumn in 2021) has been held successfully.

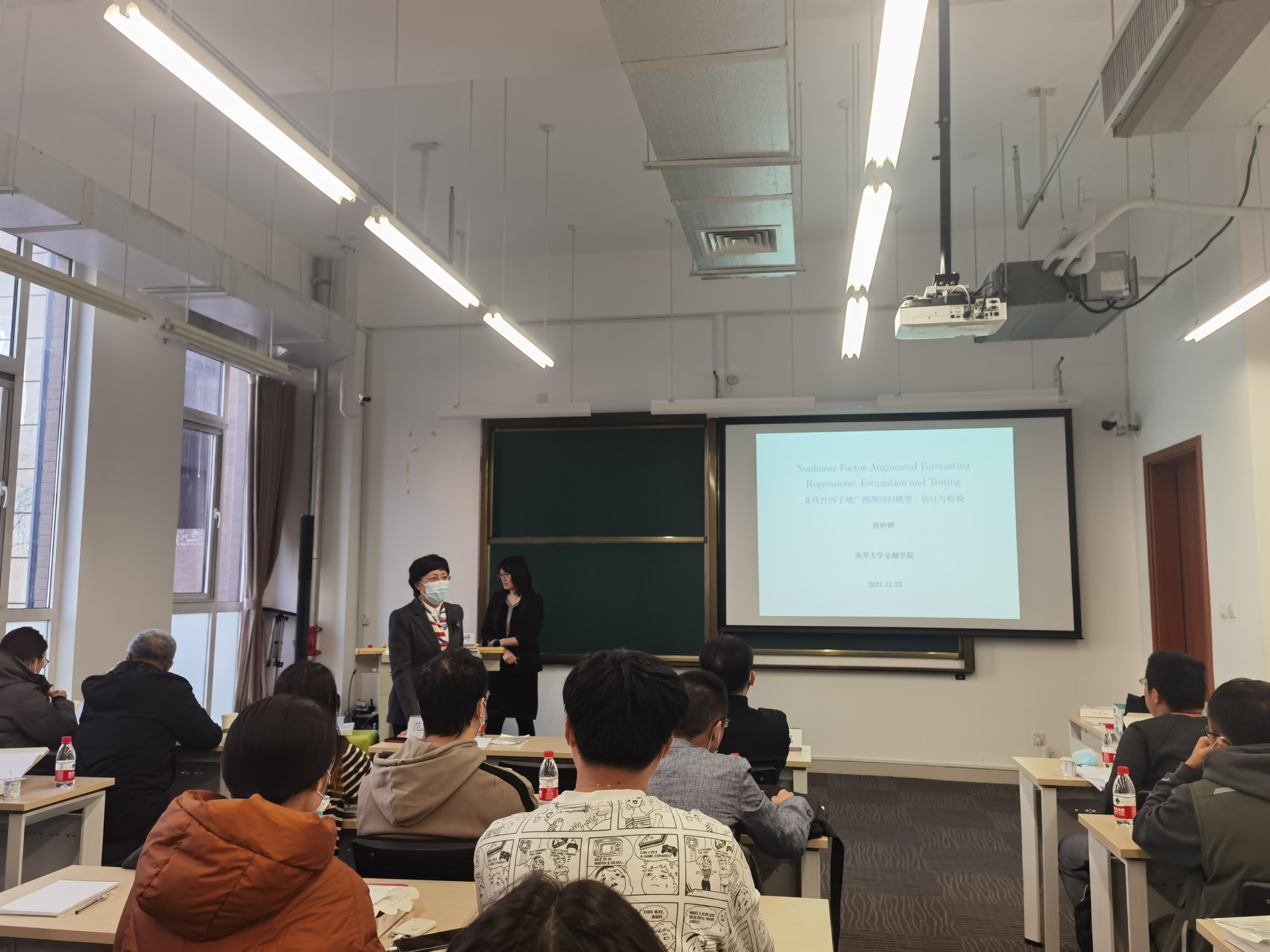

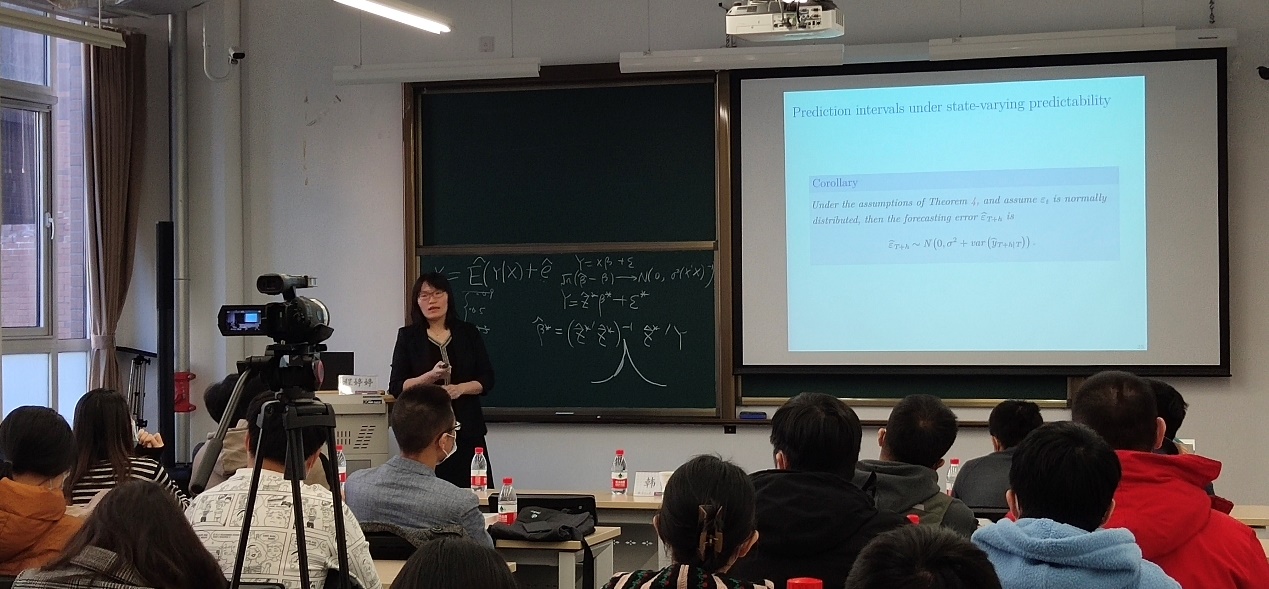

On November 23rd 2021, Dr. Tingting Cheng, an associate professor at School of Finance gave us a presentation on “Nonlinear Factor -Augmented Forecasting Regression Model: Estimation, Testing and Applications” on the 6th Noon Sunshine - Young Scholars Seminar in room 116. Her research interests include financial econometrics, time series analysis, panel data analysis, etc.

The Party committee secretary, Mr. Xu Han, and vice presidents, Professors Xiaoyun Fan and Lanbiao Liu attended this seminar. Before the beginning of this seminar, they briefly introduced Dr. Cheng’s previous work, and encouraged young scholars to actively participate the series of Brown Bag Seminar. With the strong support from School of Finance, the Noon Sunshine Seminar has become a platform for faculties and students to share their recent work and research ideas, which has also facilitated their personal growth and career development.

During the seminar, Dr. Cheng first introduced the motivation and background of the factor-augmented forecasting model. In the era of big data. how to deal with high-dimensional and high-frequency data has become an important topic in finance and economics. The factor model, one of the commonly used dimension reduction tools, plays a key role in many research fields such as macroeconomic forecasting and financial asset pricing. However, the traditional linear factor augmented regression model has its limitations. To illustrate, Dr. Cheng provided several examples to show that the assumption of constant regression coefficients over time in traditional model is unrealistic in practice.

Based on these observations, Dr. Cheng and her coauthors developed a new nonlinear factor-augmented regression model with the presence of threshold effect. Then, she presented a least squares estimation method for this new model, showed the construction of prediction interval, and also established the corresponding asymptotic theory. After that, she introduced two kinds of hypothesis tests for threshold parameter and the presence of threshold effect. To investigate the performance of these estimation and testing procedures, she reported the simulation results and further demonstrated the good performance of their proposed model through an application to stock return prediction. Finally, Dr. Cheng shared some of her ongoing projects and the future research plan related to factor-augmented forecasting model.

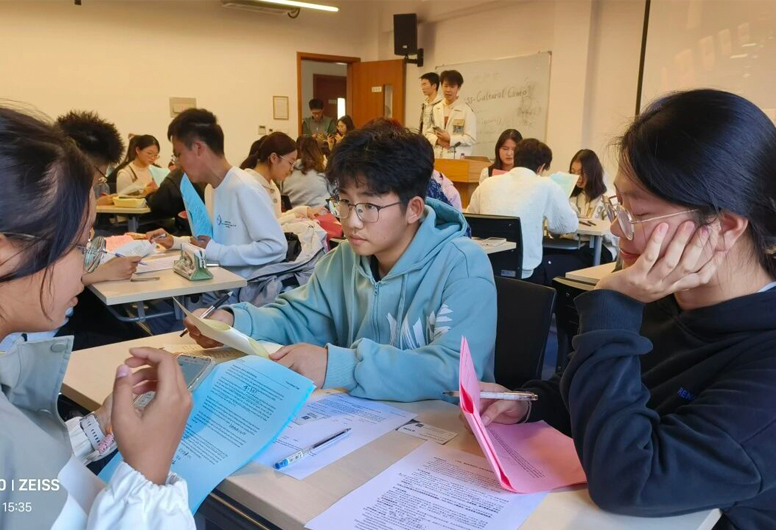

During the seminar, many faculties and students showed their interests on her presented work and raised several questions to Dr. Cheng.

As we know, the Noon Sunshine Seminars are held on a regular basis by School of Finance since its establishment. With this platform, we believe that the faculties and students can exchange their academic ideas toexplore cutting-edge research problems, and promote the opportunities for potential cooperation between them.