The third session of Noon Sunshine – Young Scholars Seminar (the Autumn in 2021) has been held successfully.

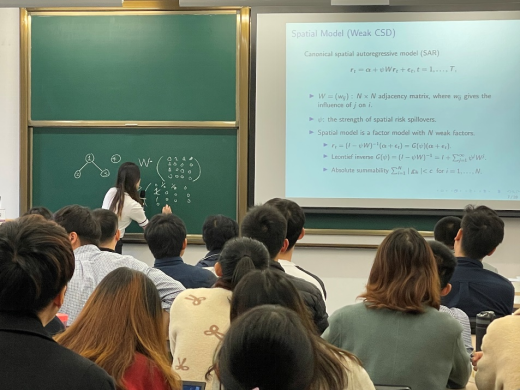

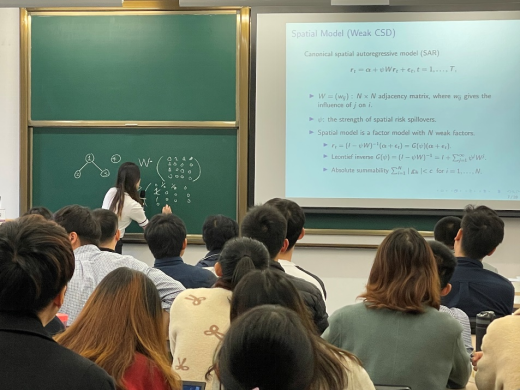

At noon on November 4, the Noon Sunshine-The third phase of the Young Scholar seminar for the fall semester of 2021 was held as scheduled at 116 of the School of Finance. The theme of this seminar is "Company Related Information Implied in News and Fractional Dependence of Stock Market". Shuyi Ge (PhD from Cambridge University), newly recruited assistant professor of the School of Finance, shared her working paper. Shuyi Ge's research fields include financial econometrics, empirical asset pricing, machine learning, network science, etc. Associate Professor Haoxi Yang of the School of Finance made the report and commented. School leaders, teachers and students actively participated, and the classroom with every seat taken.

First, Shuyi Ge introduced the topic of this lecture -- exploring the application of cross-sectional dependence in stock market. The cross-sectional dependence can be divided into strong dependence and weak dependence. Then, Shuyi Ge introduced the relevant definitions and assumptions. Strong dependence can be defined as factors that have an impact on the entire stock market (e.g., five-factor asset pricing model by Fama-French); weak dependence is the spillover effect of the interrelationship between companies (e.g., companies A and B are strategic partners, and the negative impact on A will also affect B. This dependence is fractional and will not spread to the entire market). She introduced a new asset pricing model that the model brings in fractional (weak) dependence on the basis of the traditional risk factor pricing model. Also, she and her collaborators deduced the condition of no progressive arbitrage under the new model. After that, Shuyi Ge introduced that she used news big data to build a matrix of company network relationships with certain rules and weights as a channel for local risk communication. The empirical results show that the corporate network implicit in the news is an important way for the spread of local risks. The addition of the local (weak) dependence component can well reduce the remaining cross-sectional dependence in the idiosyncratic income, and reduce the pricing error and mean square error of the model. Shuyi Ge compared the hidden network information in the news with the existing network in the literature and found that the network built with news performed better. Finally, Shuyi Ge summarized and looked forward to this lecture, hoping to find a better way to calculate and evaluate the company's spatial network relationship matrix to eliminate the noise interference caused by the collection of big data.

Haoxi Yang commented on the lecture. She concluded that this article has a clear thinking and has made a pioneering contribution to the study of cross-sectional dependence. At the same time, she pointed out that the specific definition and evaluation method of strong and weak dependence, and the detailed research of the construction method of the company's spatial network relationship matrix can still be optimized and adjusted.

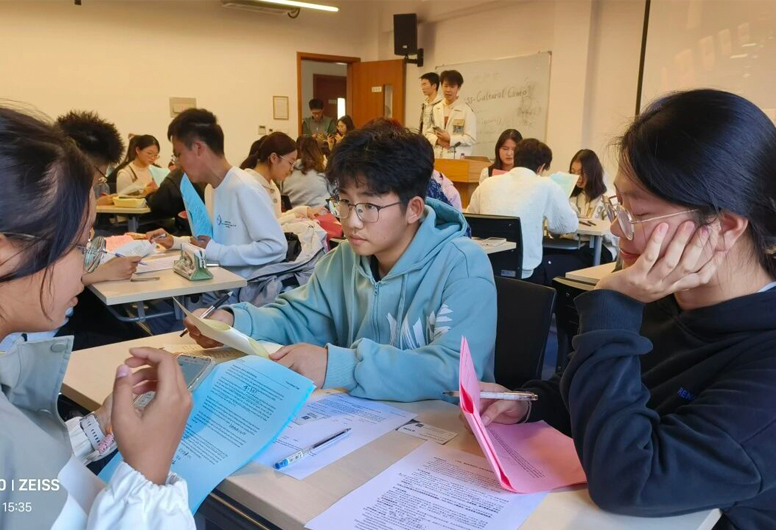

During the exchange activities, teachers and students asked Shuyi Ge questions from time to time. The discussion atmosphere was active and everyone fully enjoyed the fun of academic discussion.

"Noon Sunshine" is a regular academic exchange platform held by the School of Finance since the establishment of the Institute, which aims to help teachers focus on academic frontier issues, enhance academic exchanges and promote scientific research cooperation.