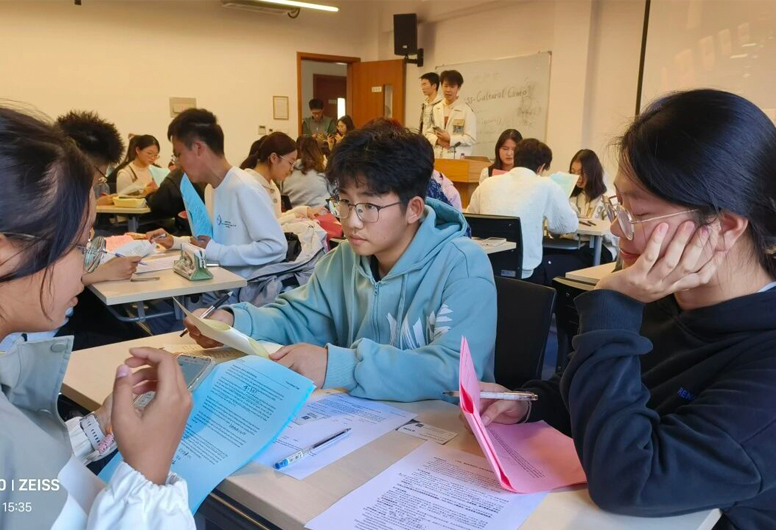

Integrated News | The Pension Finance Seminar of China Construction Bank Training Center and Nankai University School of Finance Successfully Hosted

On the morning of July 14, 2023, the Pension Finance Seminar jointly organized by the China Construction Bank Training Center and the School of Finance of Nankai University was successfully held. The theme of the conference was How Commercial Banks Can Play a Leading Role in Participating in the Construction of the Pension Financial System. Ji Zhihong, Deputy Chief Executive of China Construction Bank, attended the seminar. University President Chen Yulu met with the guests participating in the seminar.

In his address, Deputy Chief Executive Ji Zhihong introduced China Construction Bank's efforts, achievements, and advantages in the development of the pension industry, as well as its layout in the first and second pillars of pension planning, emphasizing China Construction Bank's commitment to the pension industry. He also presented China Construction Bank's concept of New Financial Construction, expressing affirmation for the academic research at Nankai University's School of Finance and the expectation for further collaboration through industry-education integration.

Fan Xiaoyun, Dean of Nankai University School of Finance, introduced the history of NKU finance and the support provided by China Construction Bank for the development of the School of Finance. She expressed gratitude for the longstanding cooperation between Nankai University's School of Finance and China Construction Bank, looking forward to future collaboration and extending thanks to China Construction Bank for its support.

The expert representatives and delegates from China Construction Bank shared their academic research findings, practical experiences, and relevant reflections on pension finance. Professor Yang Xinming, Vice Dean of the Institute of Information Studies at the Chinese Academy of Social Sciences, delivered a presentation on the topic of The Impact of Aging on the Economy and its Responses. He discussed the regular characteristics of population aging and the current situation of aging in China. Professor Yang emphasized that China is faced with a circumstance of aging before prosperity, elucidated the relationship between China's two population peaks and China’s aging, and analyzed the economic impact of population aging from both the supply and demand sides. He suggested addressing the sudden acceleration of population aging by improving the population structure, establishing a flexible retirement system, and tackling pension shortfalls through measures such as increasing revenue and reducing expenditure. Furthermore, he advocated the development of the three pillars of pensions based on a clear positioning of the third pillar.

Professor Yuan Xin, Director of the Center for Aging Development Strategy at Nankai University, delivered a presentation on Population Decline Aggravates Aging Society and National Responses. He believes that against the backdrop of continuous increases in life expectancy and declining birth rates in China, population aging and negative population growth are inevitable trends. Based on the increasing scarcity of labor resources and the continuous abundance of the overall population, he pointed out that the early stages of negative population growth exhibited characteristics of a younger elderly population. The societal burden of supporting the elderly is steadily increasing, surpassing the burden of supporting the young, which poses challenges to the sustainability of the social security system. Moreover, he elaborated on the key issues and challenges in various fields such as the economy, society, and health in an aging society. He introduced the actions taken by the country to address issues related to an aging society and outlined major tasks for the 14th Five-Year Plan period and the year 2035. These tasks include the construction of a basic elderly care service system, the improvement of a multi-level and multi-pillar pension insurance system, and the establishment of a policy system to support childbirth.

Professor Zhu Minglai, Director of the Institute of Pension and Health Security at the School of Finance of Nankai University, presented on the topic of Several Reflections on the High-Quality Development of China's Pension Finance. Firstly, he discussed the background of China's pension finance development, highlighting the large scale of the elderly population, rapid aging, the prominent issue of aging before affluence, and the need to improve the replacement rate of pension. He also noted that the frequent introduction of pension finance policies in China has released policy dividends. Secondly, Professor Zhu provided an overview of the current status and the main issues of China's pension finance from four aspects: the concept of pension finance, the construction of a multi-pillar pension system, financial services for the elderly, and financial support for the elderly care industry. Finally, he made recommendations for optimizing the design of China's pension finance system, including further optimizing policy design and improving the three-pillar pension system, precisely positioning and strengthening supervision of financial services for the elderly, adopting a service model for financial support in the elderly care industry to facilitate the flow of financial support, and other approaches.

Professor Li Quan, Director of the Institute of Finance at the School of Finance, Nankai University, presented on the topic of Exploration of Commercial Banks' Wealth Management Subsidiaries in Promoting Pension Finance—Exploration of Pension Finance Development under Fiscal and Financial Collaboration. He analyzed the current situation and constraints of public finance supporting the development of elderly care services, emphasizing that public financial funds form the foundation of elderly care services. His research revealed the significant pressure on public finance revenue and expenditure, with problems such as widening fiscal deficits and increasing pressure on local government debt. Simultaneously, with the vigorous development of pension finance driven by policies and market demand, the business scope of commercial pension finance has continued to expand. Professor Li believes that pension finance has become an important pillar of elderly care security. Finally, he suggested that commercial bank wealth management subsidiaries have great potential in the field of pension finance. He detailed the basic characteristics of pension wealth management in terms of investment duration and returns, emphasizing the need for optimization of asset allocation in wealth management subsidiaries participating in pension finance.

Professor Qin Jiaqi, Director of the Corporate Finance Research Center at the School of Finance, Nankai University, presented on the topic of China's Pension Finance and Elderly Care Industry: Problem Analysis from the Perspective of Investment and Financing. He analyzed the essence of elderly care issues, summarized the trends and problems in the evolution of China's elderly care service system, and dissected the relationship between the elderly care industry and pension finance. Based on existing research conclusions and practical situations, he speculated that relying solely on the elderly in urban and rural areas would be difficult to drive the development of the elderly care industry. Addressing the existing challenges in the elderly care industry, Professor Qin proposed recommendations from the perspective of investment and financing. On the one hand, he suggested providing more financing channels for the elderly care industry to inject new funds. On the other hand, he advocated relaxing entry barriers, distinguishing between public welfare and for-profit aspects, promoting commercial operation in profitable segments, and thus allowing elderly care institutions to achieve internal growth. Additionally, he believed that in the field of elderly care, commercial banks and the capital market should return to their financing roles. He proposed suggestions including further exploration of elderly people's needs, the development of specialized and refined products and services, leveraging the financing function of pension finance, and deepening reforms in the investment and financing system.

Yang Guang, Deputy Director of the Asset Management Department of China Construction Bank Group, shared the research findings on the pension finance business of China Construction Bank. She first summarized the current development and challenges of pension finance in China, emphasizing the urgent issues of aging before prosperity and aging without preparation. She pointed out the inadequacies in the existing pension security system in terms of coverage and guarantee level, the difficulty of sustaining traditional pension models, and the emergence of socialized elderly care. Next, she introduced the construction ideas of China Construction Bank's pension finance ‘1314’ service system, highlighting its advantages in account management, licensing, housing leasing, and on-and-off balance sheet investments. Finally, she proposed several policy recommendations for pension finance, including issuing special national bonds to replenish basic pension funds, enhancing nationwide coordination efforts, and expanding the coverage of enterprise annuities and personal pension plans. Additionally, she emphasized the need to strengthen the infrastructure of pension finance and gradually integrate the second and third pillars of the pension system.

Fang Lei, Deputy Director of the Training Center of China Construction Bank, presented on the topic Preliminary Thoughts on China's Aging Issues and Financial Responses in the Context of Chinese-style Modernization. He discussed the pressing issues in China's aging population, including the insufficient sustainability of public pension funds, inadequate wealth reserves for household elderly care, and the rising elderly dependency ratio. He suggested that addressing these challenges requires a balanced consideration of efficiency, fairness, and safety. He proposed a comprehensive approach, referred to as the Five Coordination, which involves coordinating time, collective efforts, individual efforts, processes, and forms to address aging issues in the context of China's modernization. Finally, he recommended solidifying the accumulation of public pension funds, increasing the proportion of the second and third pillars, and encouraging innovative approaches such as exploring the house-for-pension model.

During the discussion session, expert representatives engaged in in-depth sharing and exchanges on pension finance. Professor Chen Lu, the Director of the Department of Risk Management and Insurance at Nankai University's School of Finance, expressed that commercial insurance has advantages in addressing longevity risk, providing relatively stable returns, and supplying pension services. She hoped for increased attention to commercial insurance in the future to better leverage its role as a main force in the field of pensions.

Professor Wang Bo, the Director of the Digital Finance Research Institute at Nankai University, emphasized that the development of pension finance should closely monitor the global interest rates' impact on China.

Professor Fan Xiaoyun suggested that banks, when constructing risk models, should incorporate population age structure as a long-term influencing factor into their analyses.

Vice President Ji Zhihong pointed out that the urgent resolution of the significant issue of the pension gap. Against the backdrop of advancing interest rate marketization and financial marketization, attention should be given to long-term value preservation and appreciation in pension finance. In the process of asset structure transformation, the role of actuarial science in insurance can be leveraged.

More than 30 participants, including Xie Guowang, General Manager of the Asset Management Department of China Construction Bank Group; Qi Jiangong, General Manager of the Financial Intermediary Department of China Construction Bank; Cai Yarong, General Manager of the Asset Custody Business Department of China Construction Bank; Wang Kai, Deputy Dean of the Training Center of China Construction Bank; Shang Yan, Deputy General Manager of China Construction Bank Tianjin Branch, along with representatives of faculty and students from Nankai University's School of Finance attended the meeting.