Invitation: Nankai University Financial online recruitment promotion activity

Dear Employer:

Hello! Thank you for your concern and support for the employment of students in the School of Finance, Nankai University!

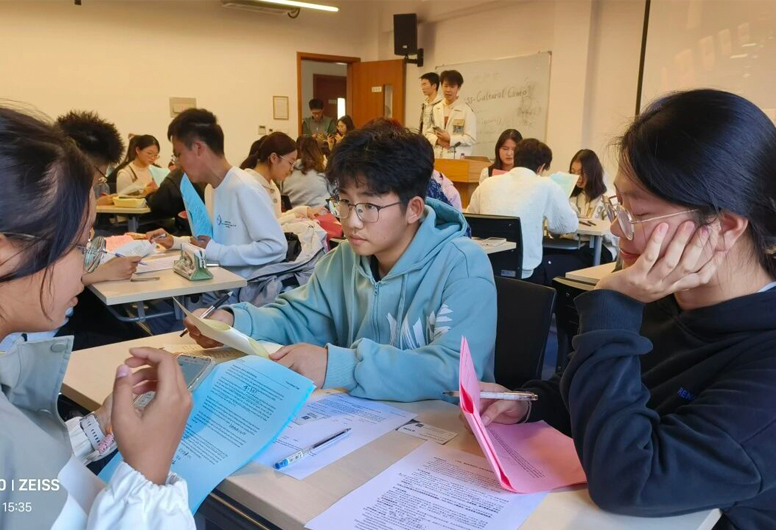

In order to further broaden the employment channels, build an exchange platform between enterprises and students, and promote more full and higher quality employment for students of our school, the School of Finance plans to hold a special online recruitment event in finance from October to December 2022. All employers are sincerely invited to participate.

The details are as follows:

1. 1. Activity Form

Due to the needs of epidemic prevention and control, the publicity activities are tentatively scheduled to be conducted online (Tencent Meeting or Feishu Meeting).

2. 2. Activity Time

From October to December 2022, the specific time of the event will be determined by the employer and the college through consultation. The event notice will be released to students before each event.

3. 3. Activity Object

In addition to students from the School of Finance, the activity will be open to students from all collage of the university.

4. 4. Way to Participate

Please scan the QR code below and fill in the relevant information to make an appointment.

After successful registration, the college will contact the person in charge of publicity of the employer to negotiate the specific activities.

This event is for public benefit and no related fees will be charged.

5. Contact information

Contact: Ms. Tang

Telephone: 022-85358213

E-mail:tanglin@nankai.edu.cn

Brief Introduction of School of Finance, Nankai University

The financial discipline of Nankai University has a long history and profound heritage. In 1919, when Nankai University was founded, the Department of Finance and Banking was established. In 1982, the department of Finance was restored and the School of Finance was established in 2015. As a special talent zone of the university, the school strives to build an international, high-level and world-class school of finance with the aim of establishing the school with first-class research, strengthening the school with first-class talents and rejuvenating the school with first-class mechanism.

The school has several teaching and research units, including the Department of Finance, the Department of Quantitative Finance, the Department of Applied Finance, the Department of Financial Economics, the Department of Risk Management and Insurance, the Department of Actuarial Science, the Institute of Finance, the Institute of Digital Finance, the Institute of Risk Management and Insurance, and the Institute of Pension and Health Care. There are 5 undergraduate programs, 4 master of science programs, 2 professional master programs, and 3 doctoral programs, forming a comprehensive and well-structured education system. The four majors of Finance, Insurance, Financial Engineering and Actuarial science were selected as the national first-class undergraduate major construction site, and the investment major was selected as the provincial first-class undergraduate major construction site. In 2021, the discipline of applied economics was newly selected as the national first-class discipline, and the Master of Finance was awarded QS five-star program.

There are 587 graduates of the School of Finance in 2023, including 251 undergraduates, 317 postgraduates and 19 doctoral students. The specific distribution of research directions and the number of graduates in each major is shown in the following table:

Education | Professional | The number of graduates | The main research direction |

Bachelor's Degree | Finance, Financial engineering, Investment | 176 | - |

Insurance | 36 | - | |

Actuarial science | 39 | - | |

Master Degree Candidate | Finance | 57 | Investment and Capital Market, Corporate Finance, Financial Risk Management, International Finance, Monetary Banking |

Financial engineering | 10 | Financial risk management, Asset pricing, Quantitative investment, Corporate finance, Financial markets | |

Insurance | 13 | Health economics and medical security, Agricultural insurance, Insurance law and regulation, Insurance Industry economics, Catastrophe and reinsurance | |

Actuarial science | 13 | Risk management, Pension insurance, Life actuarial, Non-life actuarial | |

Finance (professional degree) | 173 | Smart bank management, Corporate finance, Financial leasing, Equity investment, Financial asset management, Fintech, International financial management | |

Insurance (professional degree) | 51 | Insurance, Actuarial science | |

Doctoral candidate | Finance | 11 | Financial Engineering, Financial regulation, Asset pricing, Corporate finance, International finance, Monetary theory and policy |

Insurance | 5 | Health Economics and medical insurance, International Insurance, Insurance Legal system, Insurance Industry Economics, Insurance Economics | |

Actuarial science | 3 | Risk management and actuarial, Non-life actuarial, Actuarial theory, Financial Risk management, Insurance Economics |