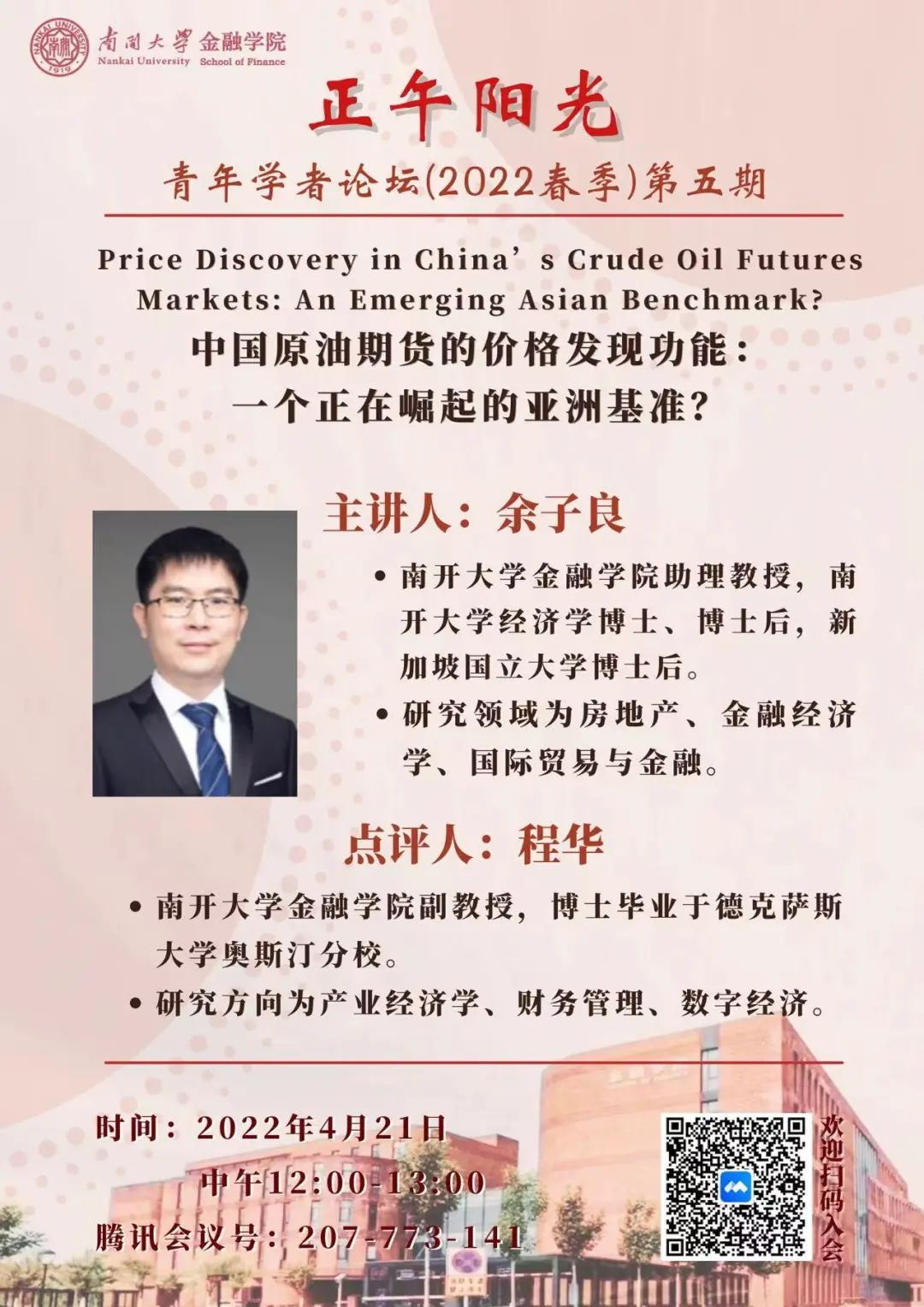

Advance Notice: the Fifth Session of Noon Sunshine-Young Scholars Seminar (the Spring in 2022)

“Noon Sunshine-Young Scholars Seminar” is a regular academic exchange platform held by School of Finance. It aims to offer valuable occasions of communications among scholars in our college, between teachers and students, the domestic and the oversea. In this semester, we keep our original intention, set off for a new voyage. We will devote ourselves to fostering the academic atmosphere in the college, and promoting the academic level for both teachers and students.

The fifth session of “Noon Sunshine-Young Scholars Seminar” for the Spring Semester in 2022 is arranged as follows:

Lecture topic

Price Discovery in China’s Crude Oil Futures Markets: An Emerging Asian Benchmark?

Keynote Speaker: Yu Ziliang

Assistant professor at the School of Finance, Nankai University, a ph.D. and postdoctoral fellow in economics at Nankai University, and a postdoctoral fellow at the National University of Singapore. His research interests include real estate, financial economics, international trade and finance. His research has been published in international and domestic academic journals such as the Journal of Empirical Finance, Regional Science and Urban Economics, Pacific-Basin Finance Journal, World Economy, and the Working Papers of Chinese Bank.

Commentator: Chen Hua

Associate Professor at School of Finance, Nankai University, Ph.D. graduating from the University of Texas at Austin. His research interests include industrial economics, financial management, and digital economy. His research results have been published in journals such as Journal of Corporate Finance and World Development.

Date

Thursday, April 21st, 2022

Time

12:00-13:00

Tencent Meeting Code

207-773-141

Abstract

We examine the price discovery performance of China’s crude oil futures traded on the Shanghai International Energy Exchange (INE) for the spot prices of 19 types of deliverable and non-deliverable Asian crude oil. We find evidence for the INE crude oil futures price discovery function even at the early stage for almost all the deliverable crudes and some non-deliverable crudes. Both the INE crude oil futures price and spot price significantly contribute to the price discovery process, with the spot prices playing a somewhat more important role. While the price discovery performance was severely damaged around a period of the COVID-19 pandemic shock intensification in China with the temporary cancellation of the nighttime trading, it actually improved to some extent after China started the recovery from the shock. Further analysis reveals that both economic fundamentals (e.g., total warehouse inventory) and trading characteristics of the contract are significant determinants of price discovery performance. The findings imply that the INE crude oil futures have evolved into a useful and important information source in pricing Asian crudes and are emerging as an Asian benchmark.