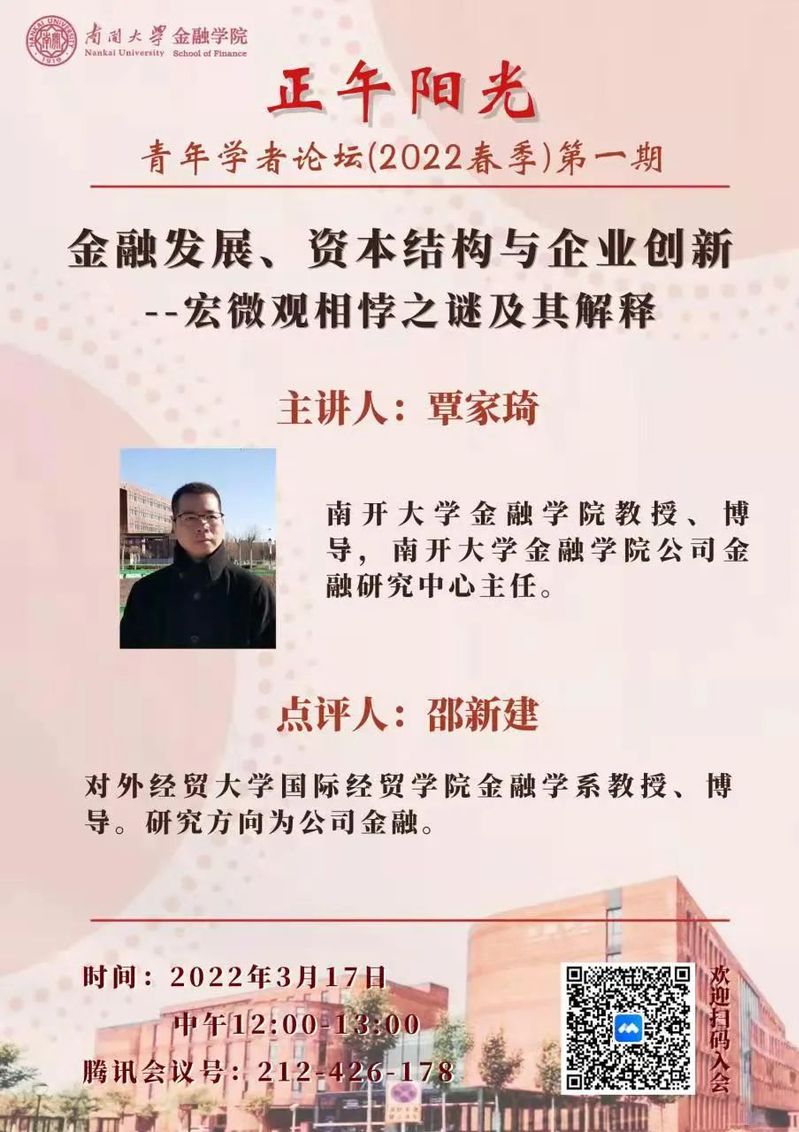

Advance Notice: the First Session of Noon Sunshine-Young Scholars Seminar (the Spring in 2022)

“Noon Sunshine-Young Scholars Seminar” is a regular academic exchange platform held by School of Finance. It aims to offer valuable occasions of communications among scholars in our college, between teachers and students, the domestic and the oversea. In this semester, we keep our original intention, and set off for a new voyage. We will devote ourselves to fostering an academic atmosphere in the college, and promoting the academic level for both teachers and students.

The first session of “Noon Sunshine-Young Scholars Seminar” for the Spring Semester in 2022 is arranged as follows:

1) Lecture Topic

Financial Development, Capital Structure and Corporate Innovation: The Mystery of the Contradiction Between Macro and Micro and Its Explanation

2) Keynote Speaker: Qin Jiaqi

Professor, doctoral supervisor of School of Finance, Nankai University and director of the Research Center of Corporate Finance, School of Finance, Nankai University

3) Commentator: Shao Xinjian

Professor and doctoral supervisor of the Department of Finance, School of International Business and Economics, University of International Business and Economics. His research field is in corporate finance.

4) Date

Thursday, March 17th, 2022

5) Time

12:00-13:00

6) Tencent Meeting Code

212-426-178

Abstract

Since Schumpeter (1912), the idea that financial development promotes corporate innovation has been widely accepted. However, financial development includes two parts: the development of equity capital market and the development of debt capital market. Behind this classification hides two logical paradoxes. First, the macro and micro paradox of debt capital: in macro, the development of debt capital market can promote corporate innovation; But in micro, the increase of debt capital will inhibit corporate innovation. Second, in micro, equity capital and debt capital are two components of the corporate capital structure. The increase in the proportion of equity capital means the decline in the proportion of debt capital. The former means to promote corporate innovation. The latter means that the debt capital market is underdeveloped, thereby inhibiting corporate innovation. This constitutes the other macro-micro paradox. How to answer these two contradictions between macro and micro? This paper proposes a logical hypothesis: financial develop -> optimal financial structure (deviation) -> optimal capital structure (deviation) -> corporate innovation (insufficient) -> economic growth. It also empirically explains the contradictions between financial development and corporate innovation from both theoretical and empirical points of view using the sample of non-financial listed companies of A-share.